The German Licensing Market No Longer Belongs to the Biggest Brands

Dubai, January 4, 2026 – The BrandTrends Group data explores how attention in the German Licensing Market is spreading, why leading brands remain strong despite declining share, and how licensing professionals must adapt their strategies to win through precision, relevance, and data driven decision making.

A mature market entering a new phase

The German licensing market of entertainment brands among people aged up to 65 years is one of the most developed and strategically important in Europe. Germany benefits from strong retail execution, high media penetration across generations, and a deeply rooted culture of licensed consumer products spanning toys, apparel, home, publishing, food, and promotions.

Historically, this market has been structured around a limited number of global entertainment powerhouses. However, recent data from BrandTrends clearly shows that the German licensing market is not weakening but structurally evolving. The market is transitioning from a concentrated model toward a more fragmented and diversified ecosystem, driven by changes in media consumption, cultural preferences, and generational behaviors.

This evolution reflects a redistribution of attention rather than a loss of engagement.

Market composition a broader Entertainment brand universe

BrandTrends data highlights a significant expansion in the number of entertainment brands known by Germans aged 0 to 65 years. Today, more than 300 different entertainment brands are spontaneously mentioned across the population. This represents an increase of 11% in just one year.

At the same time, concentration is declining. The top 100 mentioned brands now represent 75% of total mentions, compared to 83% one year earlier. Awareness is spreading across a larger pool of brands, indicating a more competitive and diluted landscape.

This shift fundamentally alters the structure of the German licensing market. Brand leadership still exists, but dominance is no longer absolute. Success increasingly depends on relevance within specific audience segments rather than universal appeal.

Leading Entertainment brands still anchor the market

Despite the growing fragmentation, global entertainment franchises continue to play a central role in brand licensing Germany.

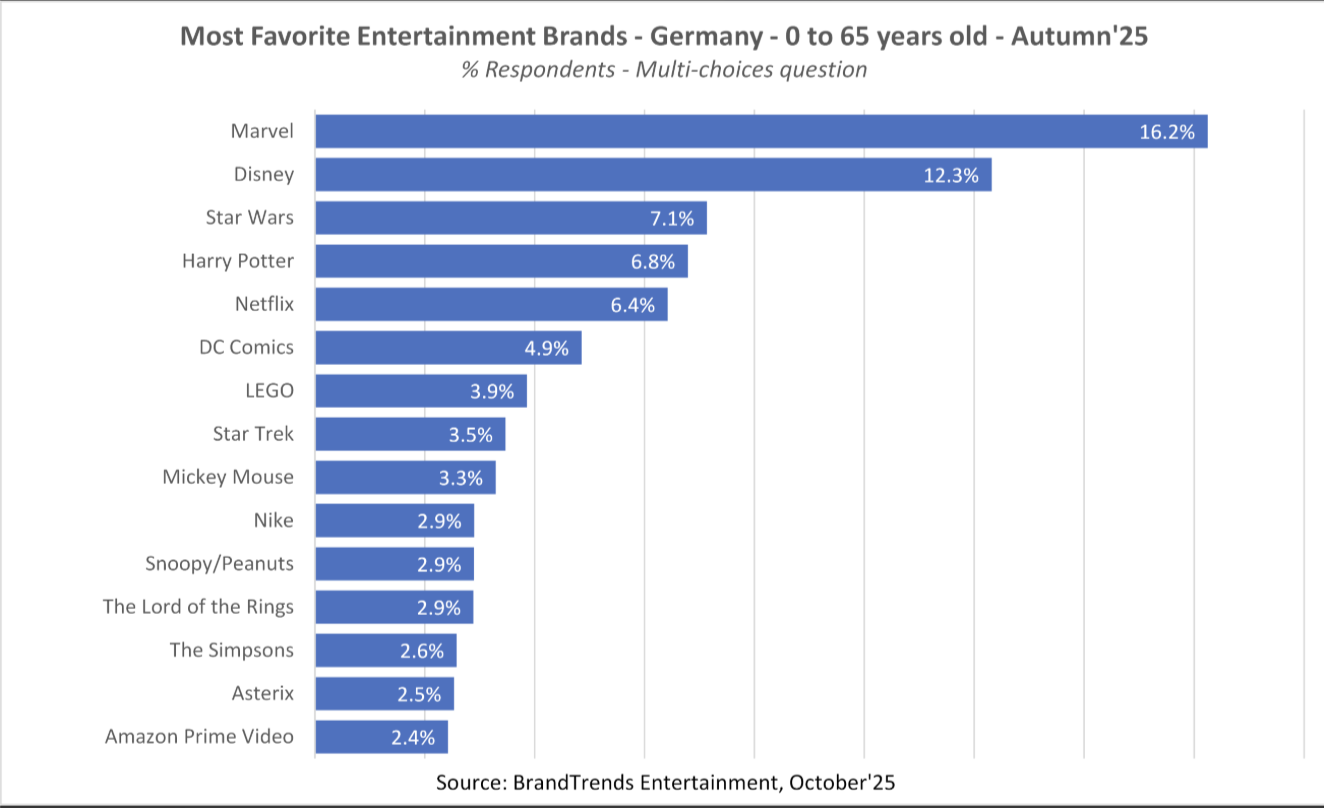

According to BrandTrends data, Marvel remains the most mentioned entertainment brand overall with 16.2% of mentions, down from 18.8% a year ago. Disney follows with 12.3%, compared to 13.4% previously, and continues to demonstrate broad multigenerational appeal, with particularly strong reach among female audiences. Star Wars stands at 7.1%, down from 8.7%, while Harry Potter remains highly stable at 6.8%, compared to 7.0% one year earlier.

BrandTrends analysis shows that these declines should not be interpreted as brand fatigue. As the total number of brands in awareness increases, the share of attention naturally disperses. Within a larger and more competitive universe, maintaining double digit or high single digit mention levels remains a strong indicator of brand power.

Marvel’s evolution illustrates this clearly. Its reduced share reflects a broader competitive field rather

than a loss of engagement across age groups.

How Germans engage with licensed Entertainment brands

Across the 0 to 65 age spectrum, BrandTrends data highlights several consistent engagement patterns.

- First, engagement is increasingly driven by narrative depth rather than by logo recognition alone. Entertainment brands with rich universes, recurring characters, and multiple entry points perform best across generations. This explains the sustained strength of franchises such as Marvel, Star Wars, and Harry Potter among both younger and older audiences.

- Second, gender dynamics remain an important structuring factor. Legacy characters such as Mickey Mouse or Snoopy show stronger resonance among female audiences, supported by emotional storytelling and family friendly positioning. In contrast, some heritage European brands such as Asterix show a pronounced male skew, with 4.1% reach among men versus only 0.9% among women. This suggests that content evolution and inclusivity remain key growth levers.

- Third, licensed entertainment brands increasingly function as cultural and identity markers. Among younger adults, brands linked to gaming, streaming, and fandom cultures play a central role in self-expression. Among older audiences, nostalgia and franchise longevity strongly influence engagement.

The rise of niche and emerging Entertainment brands

One of the most significant shifts observed by BrandTrends is the rise of niche and emerging entertainment brands across all age groups.

The declining share of mentions among the top 100 brands indicates that smaller, regional, and newer intellectual properties are gaining visibility. New entrants from gaming, anime, digital creators, and platform native franchises are successfully capturing attention alongside traditional entertainment giants.

Digital platforms play a critical role in this evolution. YouTube, TikTok, Twitch, and streaming services enable brands to build awareness without traditional mass media scale. This dynamic accelerates fragmentation and reshapes consumer licensing trends in Germany.

Hyper personalization and fragmented cultural preferences

BrandTrends data clearly shows that Germans are no longer driven by a limited set of shared cultural tentpoles. Preferences are increasingly personalized, segmented, and driven by platform specific ecosystems.

Different age groups now engage with different brand universes, often with limited overlap. Children, teenagers, young adults, parents, and older consumers each follow distinct cultural pathways. Licensing strategies that rely on one size fits all logic are therefore becoming less effective.

Philippe Guinaudeau explains: “The German licensing market is no longer about winning one dominant cultural moment. It is about winning relevance across many fragmented audiences. Data is what allows brands to navigate this complexity with confidence.”

Key challenges facing the German Licensing market

This structural transformation comes with several challenges.

Market saturation is increasing. With more entertainment brands competing for attention, shelf space and consumer mindshare are harder to secure. Over licensing without differentiation increases commercial risk.

Economic pressure is also rising. In the context of the global war on tariffs and cost inflation, licensing decisions must now deliver profitability as well as visibility. This puts pressure on licensees and retailers to make sharper brand choices.

Retail transformation further amplifies these dynamics. Shorter product cycles, faster rotations, and performance driven assortment management favor licensing strategies that are flexible and data driven.

Strategic implications for Licensing professionals

BrandTrends insights point to clear strategic shifts across the licensing value chain.

Brand strategies must move beyond reliance on blockbuster franchises and embrace diversified portfolios. Licensing agreements should prioritize flexibility and speed. Retail and merchandising strategies must support both leading franchises and long-tail entertainment brands. Marketing efforts should rely on segmentation rather than mass messaging. Digital strategies should increasingly involve partnerships with creator led and platform native intellectual properties.

Big Entertainment brands are not in crisis but must adapt

Marvel, Disney, LEGO, and other global leaders remain exceptionally powerful within the German licensing market. BrandTrends data shows that they are not losing relevance but operating in a denser and more competitive environment.

Their advantage lies in scale, but future success depends on their ability to activate sub franchises, tailor narratives to specific audiences, and coexist with emerging brands. Brand unbundling and targeted storytelling are becoming essential strategic tools.

Final takeaway:

The German licensing market of entertainment brands among people aged 0 to 65 years has evolved from a top-heavy structure into a broad and competitive cultural ecosystem.

This new environment rewards speed, cultural agility, and relevance over legacy alone. For licensors, licensees, agents, and retailers, BrandTrends insights are essential to navigate this complexity and make better licensing decisions in Germany.

In today’s market, success is no longer about being the biggest brand. It is about being the most

relevant to the right audience at the right time.

ABOUT THE REPORT

The current report provides a detailed analysis of brand awareness, popularity, and purchase intent of the most important Entertainment brands within a country. The most crucial aspect is that it predicts product category purchasing intentions. The service reports on 11,500 different Entertainment, Fashion, or Sports brands four times a year, and interviews 200,000 people ranging in age from infants to seniors in 42 countries.

ABOUT BRANDTRENDS

BrandTrends is the global benchmark in brand and licensing intelligence, recognized as the gold standard in the industry.

Specializing in brand equity, consumer behavior, and lifestyle trends—particularly among children, youth, and families—BrandTrends operates in up to 53 markets annually, providing consistent, in- depth insights into brand performance and consumer sentiment worldwide.

What sets BrandTrends apart is its ability to turn complexity into clarity. Its team of expert analysts and data scientists uses proprietary tools like the Brand Popularity Index and Consumer Demand Gap to deliver actionable, strategic foresight. These insights help clients optimize retail activations, brand positioning, and product development.

At the core of its methodology is the seamless integration of advanced technology and AI— enhancing every stage of the research process, from data collection to analysis and delivery, with speed, scale, and precision.

Trusted by global corporations and smaller organizations alike, BrandTrends is committed to democratizing market intelligence and elevating the licensing ecosystem.

To learn more, visit www.brandtrends.ai.

If you would like more information about this topic, please contact Philippe Guinaudeau - BrandTrends.AI at philippe.guinaudeau@brandtrends.ai.