Who Really Controls Consumer Attention in the Australian Licensing Market

Australia is often perceived as a secondary licensing market due to its population size. BrandTrends Group data suggests otherwise. The Australian licensing ecosystem is compact, highly structured, and strongly dominated by a limited number of global entertainment brands. This concentration shapes consumer behavior, retail dynamics, and licensing outcomes across all age groups up to 65 years old.

Rather than a fragmented landscape, Australia presents a clear hierarchy of brands. Visibility, engagement, and purchasing potential are unevenly distributed, creating both stability and constraint for industry players.

A market structured around a small number of dominant brands

BrandTrends Group analysis of the Top 100 entertainment brands in Australia shows a pronounced imbalance in brand reach.

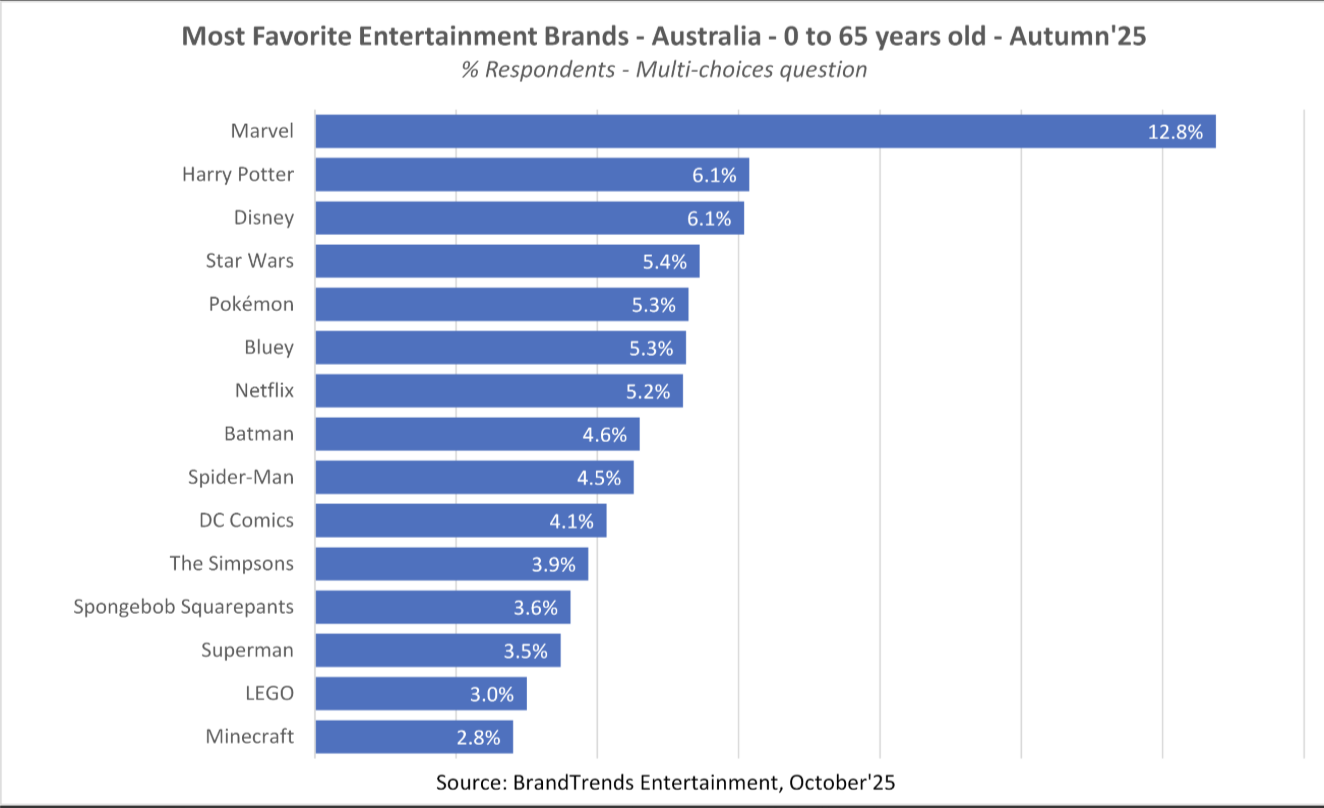

Marvel leads with 12.8% of total brand mentions. The next closest brand, Harry Potter, reaches 6.1%. Disney, Star Wars, Pokémon, and Bluey follow, each benefiting from sustained media exposure and multi category licensing.

The cumulative effect is significant. According to BrandTrends data, the Top 10 brands account for 44% of all mentions. Expanding the scope to the Top 30 captures 70% of total mentions.

This level of concentration reduces the number of brands that meaningfully compete for consumer attention. It also raises the cost of entry for new properties and increases dependency on established brands for licensees and retailers.

Narrative scale drives licensing demand

The Australian licensing market remains primarily driven by entertainment and character-based brands.

BrandTrends data shows that TV series, comic originated properties, and corporate entertainment brands dominate both the number of active licenses and their share of consumer mentions. Comic based brands in particular generate a disproportionately high share of mentions relative to their number.

This suggests that engagement intensity, not brand volume, is the critical driver of licensing value. Brands with strong narrative universes and recurring content cycles generate sustained attention, which translates into repeat purchasing behavior.

Cross media exposure remains a structural advantage. Brands that operate across film, streaming, gaming, and consumer products maintain higher baseline relevance than single platform properties.

Children influence demand but do not define the market

Children play an important role in shaping brand awareness, but BrandTrends Group data indicates that licensing demand in Australia extends well beyond childhood.

Marvel alone counts approximately 2.89 million super fans in Australia. Harry Potter and Disney each exceed 1.3 million super fans. These consumers demonstrate high levels of emotional attachment and repeat engagement.

Age distribution analysis reveals two concentration points. One appears among teenagers aged 12 to 18. The second appears among adults aged 30 to 45. This dual structure reflects both current youth engagement and long-term brand retention through nostalgia.

As a result, licensed products increasingly target households rather than children alone. Apparel, collectibles, home items, and premium collaborations benefit from adult purchasing power while remaining anchored in child driven awareness.

Gender neutrality is now a baseline requirement

One of the most notable characteristics of the Australian licensing market is its gender balance.

BrandTrends Group data shows that 63% of brand mentions are gender neutral. Male only brands account for 20% of mentions, while female only brands represent 17%.

Several major brands sit close to the center of the gender spectrum. The Simpsons, Harry Potter, Super Mario, and Netflix display balanced appeal across genders. Other brands show clearer orientation. Marvel, Star Wars, DC Comics, and Nike skew male. Barbie, Hello Kitty, SpongeBob, and Friends skew female.

Marvel remains the leading brand for both groups, with 16.1% share among males and 9.4% among females. This suggests that gender inclusivity does not dilute engagement. It expands potential reach.

For licensees, gender neutral brands offer broader SKU efficiency and retail flexibility. For licensors, they reduce dependency on narrowly defined demographic targets.

Household predicts signals commercial readiness

Beyond awareness and affinity, BrandTrends Group tracks household penetration as a key indicator of licensing performance.

Marvel leads with 12.2% household penetration. Harry Potter, Disney, Bluey, and Pokémon also demonstrate strong in-home presence. These brands extend beyond toys into apparel, home goods, and everyday consumer products.

Household penetration correlates closely with purchasing frequency and category expansion potential. Brands present in the home benefit from shared usage, visibility across age groups, and higher long-term value per consumer.

Super fan behavior highlights expansion potential

Analysis of super fan behavior provides insight into potential licensing extensions.

BrandTrends data shows that Marvel super fans in Australia also actively engage with DC Comics at 21%, LEGO at 17%, Netflix at 11%, and Disney at 10%. This overlap indicates shared interest across entertainment ecosystems rather than isolated brand loyalty.

Income analysis shows that most super fans fall within middle to high income brackets. Many live in households with no children or only one child. This profile supports premium licensing strategies, adult focused collections, and limited edition products.

Structural pressures facing the market

Despite its stability, the Australian licensing market faces increasing pressure.

Market saturation limits visibility for new brands. Economic constraints, including global tariff tensions and cost inflation, affect pricing and margins. Retail transformation continues to reshape how consumers discover and purchase licensed products.

In this context, reliance on intuition carries higher risk. Data driven selection becomes essential for prioritizing brands with proven household penetration and engagement depth.

What the Australian licensing market demands

The Australian licensing market operates on selectivity rather than volume. It rewards precision.

BrandTrends Group data shows a market shaped by concentration, where a limited number of global brands account for most consumer attention and household presence. Engagement is uneven, and licensing outcomes reflect that imbalance.

Children contribute to awareness, but sustained demand increasingly comes from households and adults. Brands that perform best combine cross generational appeal, gender balance, and consistent content exposure. Peaks in interest are tied to media cycles, not to the number of products available on shelves.

This structure leaves little room for approximation. Licensing strategies that rely on brand visibility alone overlook the importance of engagement depth, fan intensity, and purchasing context.

The most logical next step is to move from broad brand portfolios to more focused choices. To evaluate licenses based on evidence of household relevance and long-term engagement. And to align product development and retail timing with how and when consumers actually pay attention.

Understanding these dynamics does not guarantee success. Unfortunately, ignoring them makes underperformance more likely.

ABOUT THE REPORT

The current report provides a detailed analysis of brand awareness, popularity, and purchase intent of the most important Entertainment brands within a country. The most crucial aspect is that it predicts product category purchasing intentions. The service reports on 11,500 different Entertainment, Fashion, or Sports brands four times a year, and interviews 200,000 people ranging in age from infants to seniors in 42 countries.

ABOUT BRANDTRENDS GROUP

BrandTrends Group is the global benchmark in brand and licensing intelligence, recognized as the gold standard in the industry.

Specializing in brand equity, consumer behavior, and lifestyle trends—particularly among children, youth, and families—BrandTrends operates in up to 53 markets annually, providing consistent, in-depth insights into brand performance and consumer sentiment worldwide.

What sets BrandTrends apart is its ability to turn complexity into clarity. Its team of expert analysts and data scientists uses proprietary tools like the Brand Popularity Index and Consumer Demand Gap to deliver actionable, strategic foresight. These insights help clients optimize retail activations, brand positioning, and product development.

At the core of its methodology is the seamless integration of advanced technology and AI—enhancing every stage of the research process, from data collection to analysis and delivery, with speed, scale, and precision.

Trusted by global corporations and smaller organizations alike, BrandTrends is committed to democratizing market intelligence and elevating the licensing ecosystem.

To learn more, visit www.brandtrends.ai.

If you would like more information about this topic, please contact Philippe Guinaudeau - BrandTrends.AI at philippe.guinaudeau@brandtrends.ai.