The Nordic Licensing Equation

The Nordic licensing market is often perceived as compact, mature, and culturally homogeneous. Yet data from BrandTrends reveals a far more nuanced reality. Denmark and Sweden together form one of Europe’s most sophisticated licensing environments, where high purchasing power, strong cultural values, and digitally mature consumers intersect with a highly selective approach to brands.

Drawing on BrandTrends proprietary research among people up to 65 years old, this article explores how entertainment brands perform in the Nordics, how consumers engage with licensed properties across genders, and what this means for licensors, licensees, agents, and retailers seeking sustainable growth in a competitive environment.

A concentrated yet selective market

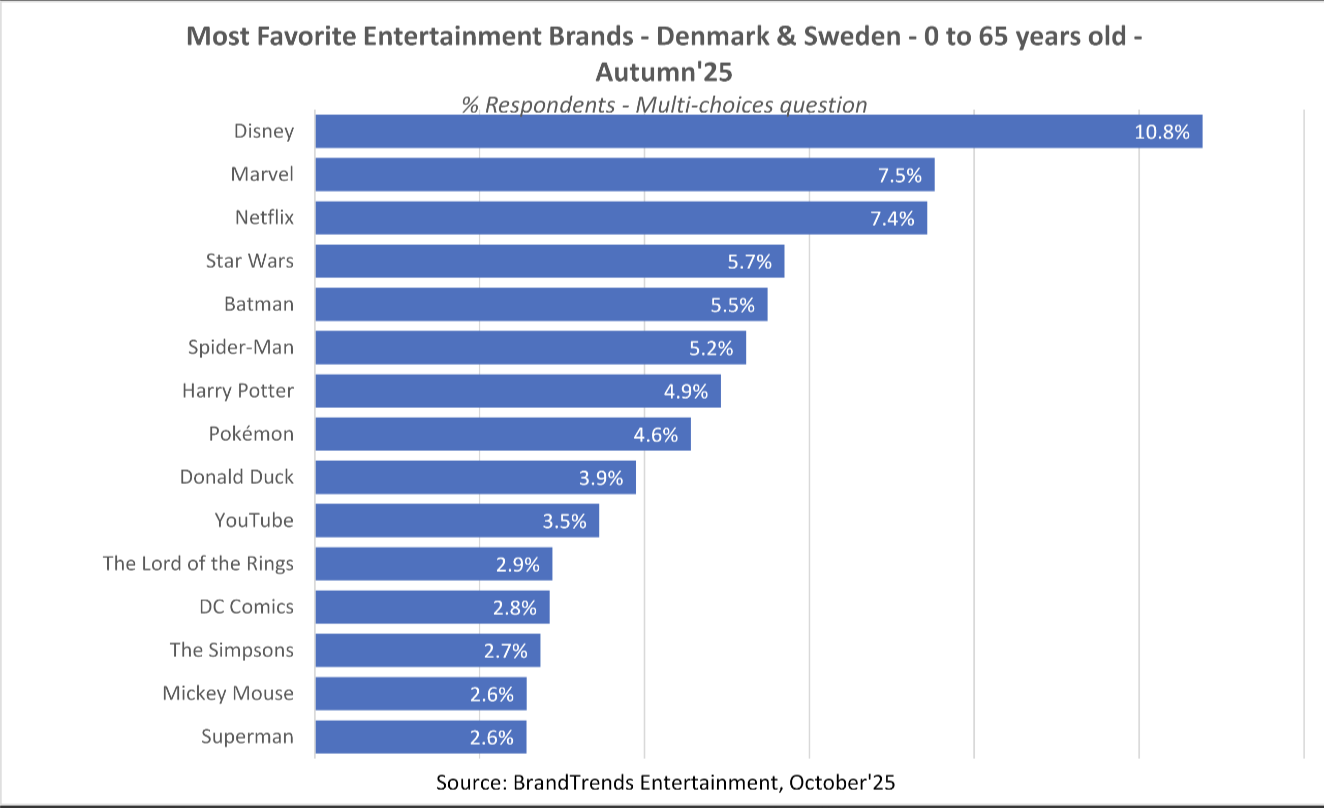

According to BrandTrends, the Nordic licensing market is clearly structured around a limited number of dominant global entertainment brands, followed by a long tail of secondary and niche properties. Consumer mention reach data highlights a tiered ecosystem rather than a flat competitive field.

At the top, three brands dominate overall consumer mindshare. Disney leads with a mention reach of 10.8% across genders. Marvel follows at 7.5%, with Netflix close behind at 7.4%. These three brands alone capture a disproportionate share of attention, reflecting their multi-platform presence, constant content renewal, and strong retail activation.

A second tier of brands operates just below this leadership group. Star Wars reaches 5.7%, Batman 5.5%, and Spider Man 5.2%. These brands remain highly visible but tend to rely on more defined fandoms and genre specific engagement.

The third tier includes brands such as Harry Potter at 4.9%, Pokémon at 4.6%, and Donald Duck at 3.9%. While their reach is lower, their cultural depth and historical presence in Nordic households provide enduring licensing value, particularly when activated strategically.

This structure illustrates a concentrated market where scale matters, but where relevance and cultural alignment determine long term performance.

Brand reach alone is not enough in Denmark and Sweden

One of the defining characteristics of the Nordic licensing market is the family centric nature of consumption. BrandTrends data shows that children are often introduced to licensed brands through shared family experiences such as streaming, cinema, gaming, and co viewing. This dynamic reinforces brands that can operate across age groups rather than targeting children alone.

Disney exemplifies this model. Its strong performance among both genders and across ages reflects its ability to connect early childhood content, youth franchises, and adult nostalgia within a single ecosystem. This makes Disney particularly effective for categories such as apparel, home products, publishing, and family entertainment.

Marvel and Spider Man benefit from a similar dynamic, with children discovering characters through movies and games, while older audiences remain engaged through long running story universes. In contrast, brands that rely on narrower age windows or single content formats face faster fatigue in the Nordic context.

Gender is a strategic variable, not a detail

Understanding gender driven engagement is essential in the Nordics, where consumers expect relevance and authenticity. BrandTrends data highlights clear gender patterns that can directly inform licensing strategy.

Female leaning brands

Several brands demonstrate stronger resonance among female audiences. Disney records a female mention reach of 12.5% compared with 9.1% among males. Netflix shows an even sharper contrast, with 10.1% among females versus 4.9% among males. Harry Potter stands out with one of the strongest skews, reaching 8.5% among females compared with only 1.6% among males. Donald Duck also shows higher female engagement.

These brands tend to align with storytelling depth, emotional connection, and character driven universes. For licensees, this creates strong opportunities in lifestyle categories such as fashion, beauty accessories, publishing, wellness products, and home décor.

Male leaning brands

On the male side, action driven and fantasy franchises dominate. Star Wars reaches 8.4% among males versus 2.8% among females. Batman follows a similar pattern, with 8.3% among males and 2.5% among females. Pokémon, Spider Man, DC Comics, and The Lord of the Rings also show clear male dominance.

These properties perform particularly well in categories such as collectibles, gaming, tech accessories, toys, and hobby driven merchandise. In the Nordic market, where adult fans represent a significant share of spending, these brands benefit from premium positioning rather than mass distribution.

The gap between mega brands and the long tail keeps widening

BrandTrends analysis allows the Nordic licensing market to be grouped into several strategic brand types.

Entertainment giants such as Disney, Netflix, and YouTube benefit from constant visibility across screens, retail, and social platforms. Their strength lies in universality and scale.

Superhero universes including Marvel, DC, Batman, and Spider Man rely on structured worlds and loyal fan bases. Their challenge is to expand beyond gender polarization while maintaining authenticity.

Fantasy and science fiction franchises such as Star Wars, Harry Potter, and The Lord of the Rings offer immersive universes with long term licensing potential, especially when supported by new content cycles.

Classic characters like Donald Duck, Mickey Mouse, and Pokémon retain strong awareness but increasingly depend on nostalgia driven activations aimed at adults rather than children alone.

Saturation, cost pressure, and retail reinvention

Despite its strengths, the Nordic market faces several structural challenges.

Market saturation is a growing issue. Consumers are exposed to a high number of licensed products, making differentiation increasingly difficult. Only brands with clear purpose and strong storytelling break through consistently.

Economic pressure also plays a role. The global war on tariffs and rising production costs affect pricing strategies, particularly in premium Nordic retail environments where consumers are value conscious but quality driven.

Retail transformation is another critical factor. Physical retail remains important, but it must integrate seamlessly with digital discovery and e commerce. Licensing strategies that fail to adapt to omnichannel expectations risk underperformance.

“Denmark and Sweden are not markets where licensing works by default. Our data clearly shows that relevance, trust, and emotional connection drive performance far more than sheer brand awareness. Licensing decisions in the Nordics must be informed, selective, and grounded in real consumer insight.”

Solving the Nordic Licensing equation with evidence, not assumptions

The Nordic licensing market is dominated by a small group of global entertainment leaders, with Disney clearly at the top. Gender driven engagement patterns create clear opportunities for targeted licensing strategies. Female audiences gravitate toward narrative rich brands like Harry Potter, Netflix, and Disney, while male audiences favor action and fantasy universes.

Legacy brands still matter, but their future lies in adult focused and nostalgia driven activations. Finally, economic pressure and retail transformation demand smarter, data led decisions.

ABOUT THE REPORT

The current report provides a detailed analysis of brand awareness, popularity, and purchase intent of the most important Entertainment brands within a country. The most crucial aspect is that it predicts product category purchasing intentions. The service reports on 11,500 different Entertainment, Fashion, or Sports brands four times a year, and interviews 200,000 people ranging in age from infants to seniors in 42 countries.

ABOUT BRANDTRENDS GROUP

BrandTrends Group is the global benchmark in brand and licensing intelligence, recognized as the gold standard in the industry.

Specializing in brand equity, consumer behavior, and lifestyle trends—particularly among children, youth, and families—BrandTrends operates in up to 53 markets annually, providing consistent, in-depth insights into brand performance and consumer sentiment worldwide.

What sets BrandTrends apart is its ability to turn complexity into clarity. Its team of expert analysts and data scientists uses proprietary tools like the Brand Popularity Index and Consumer Demand Gap to deliver actionable, strategic foresight. These insights help clients optimize retail activations, brand positioning, and product development.

At the core of its methodology is the seamless integration of advanced technology and AI—enhancing every stage of the research process, from data collection to analysis and delivery, with speed, scale, and precision.

Trusted by global corporations and smaller organizations alike, BrandTrends is committed to democratizing market intelligence and elevating the licensing ecosystem.

To learn more, visit www.brandtrends.ai.

If you would like more information about this topic, please contact Philippe Guinaudeau - BrandTrends.AI at philippe.guinaudeau@brandtrends.ai.